Egypt’s ICT sector is one of the fastest economic contributors to GDP. The overall revenues for the sector in 2018 surpassed EUR 4 000 million and are expected to reach EUR 5 100 million by 2020. The growth rate reached 14.1% in 2017/2018, against 12.5% in 2016/2017

The government has invested heavily in telecom infrastructure. Introduction of 4G technology in mobile services was introduced in 2016. Progressive infrastructure upgrades and fiber optical cable deployment is ongoing throughout the entire nation. Egypt is well connected to over 60 countries being at the intersection of 15 global submarine cable lines that hold 60 Tbps cable capacity. Connection to the MENA and SE-ME-WE 5 cables improved national bandwidth. It also has an extensive national fibre backbone.

This has accelerated the development of ICT services. Public cloud and BPO services are core contributors to the sector’s growth. The sector in 2017 exported EUR 3 100 million. In 2017 the combined IT, BPO, and KPO sectors exported EUR 3 100 million and exports could easily reach EUR 4 550 million in 2020.

Telecommunications: Egypt has one of the largest telecommunication markets in Africa. The sector has effective competition and penetration rates exceeding 100%. The ‘Arab Spring’ revolution adversely affected profit margins and capital expenditure due to the depreciation, nonetheless revenue has remained stable. End-user access prices are among the lowest internet data rates globally.

Egypt is home to one of the most vibrant Fiber to the Home (FTTH) deployments. This is a pure fiber-optic cable connection running from an Internet Service Provider (ISP) directly to Egyptian homes and businesses which has been bolstered by ongoing national urbanization.

Egypt was among the first in the region to launch 3G mobile services, but the rollout of LTE services suffered from delays in issuing spectrum which was finally solved in 2016 through fifteen-year 4G licenses. Operators launched 4G in September 2017. Efforts are ongoing to offer Converged IP Networks.

A key development was the awarding of unified licenses which allowed operators to offer fixed-line and mobile sectors services. The mobile network operators can offer ‘virtual’ fixed-line services hosted by Telecom Egypt’s infrastructure.

The main mobile network providers are Vodafone Egypt, Orange Egypt, Etisalat Misr, and Telecom Egypt owned WE.

Orange received 10 MHz of 4G frequency bands for EUR 423 million. Etisalat received 10 MHz of bandwidth for EUR 467 million. Vodafone received 5 MHz of frequency bands for EUR 292 million. Telecom Egypt received 15 MHz in bandwidth for EUR 268 million, and an additional EUR 107 million for the license itself. The average price for 4G bandwidth was EUR 547 million and a MHz price of EUR 36 million.

Egypt’s three private mobile network operators; Orange, Vodafone, and Etisalat received fixed line service licenses in 2016 and are preparing their launch. They concluded testing fixed line services with Telecom Egypt but as it is not a lucrative segment the private operators are delaying its launch. Orange, in particular, might move ahead in early 2019.

Internet penetration: Overall, internet penetration is relatively low at 37.8 %. Egypt wants to improve its broadband internet penetration rate which was 43.3% in 2015. However, there is a notable decrease in fixed-line penetration growth with the trend pointing to an increase in mobile penetration.

Its mobile SIM penetration rate is one of the highest mobile phone penetration rates in the EMEA region and has surpassed 113%, however, interestingly, only 29.42 % of these subscriptions have internet access. Smartphone penetration rate is 58%, and the annual growth rate of mobile internet users is 3.35%. The increasing use of online and social media is contributing to penetration levels.

5G in Egypt: The telecommunications sector should focus on fully using its currently available 4G spectrum. The National Telecommunications Regulatory Authority (NTRA) might begin selling 5G spectra 2020.

Physical Infrastructure: Egypt’s internet infrastructure is quite centralized. State-owned Telecom Egypt owns Egypt’s telecommunications infrastructure, and it leases licenses to Internet Service Providers. In mid-2018 Orange Egypt, Vodafone, Telecom Egypt signed a EUR 1 789 million infrastructure sharing deal.

Continuous investments have improved the availability of electric power utilities and significant international bandwidth in telecommunications has been added to ensure the connectivity of offshoring companies.

Egypt lies at the heart of a worldwide cable network, and the increasing use of its high-quality international submarine cables has significantly improved internet connectivity for companies.

In addition, state-owned operator Telecom Egypt (TE) is collaborating with Liquid Telecom to complete a cross-border fiber optic network cable linking southern Africa. The network will connect Sudan through Cairo and allow Telecom Egypt to connect users through Liquid Telecom’s high-speed fiber-optic network and investments over three years starting in 2019 could reach EUR 378 million.

Digital transformation (DX): As global economies embrace the concept, Egypt’s government is working to position the nation as a major hub for technology services and placing DX at the center of its national strategy. Other countries undertaking these initiatives which see digital technology solving the population’s traditional problems often face resource constraints. Egypt is capitalizing on its call center expertise that has seen it become the preferred regional outsourcing services hub to diversify and apply its labor force to increase export services within the segment.

It has several large contact center outsourcing operations with over 1 000 employees and numerous small firms. The current total customer care labor pool reaches 95 000 professionals.

Egypt is considered one of the fastest-growing offshore destinations in the world and its BPO and IT industry increasingly gained global market share. The segment is expected to record a CAGR of 14.2% for the 2017–2020 period.

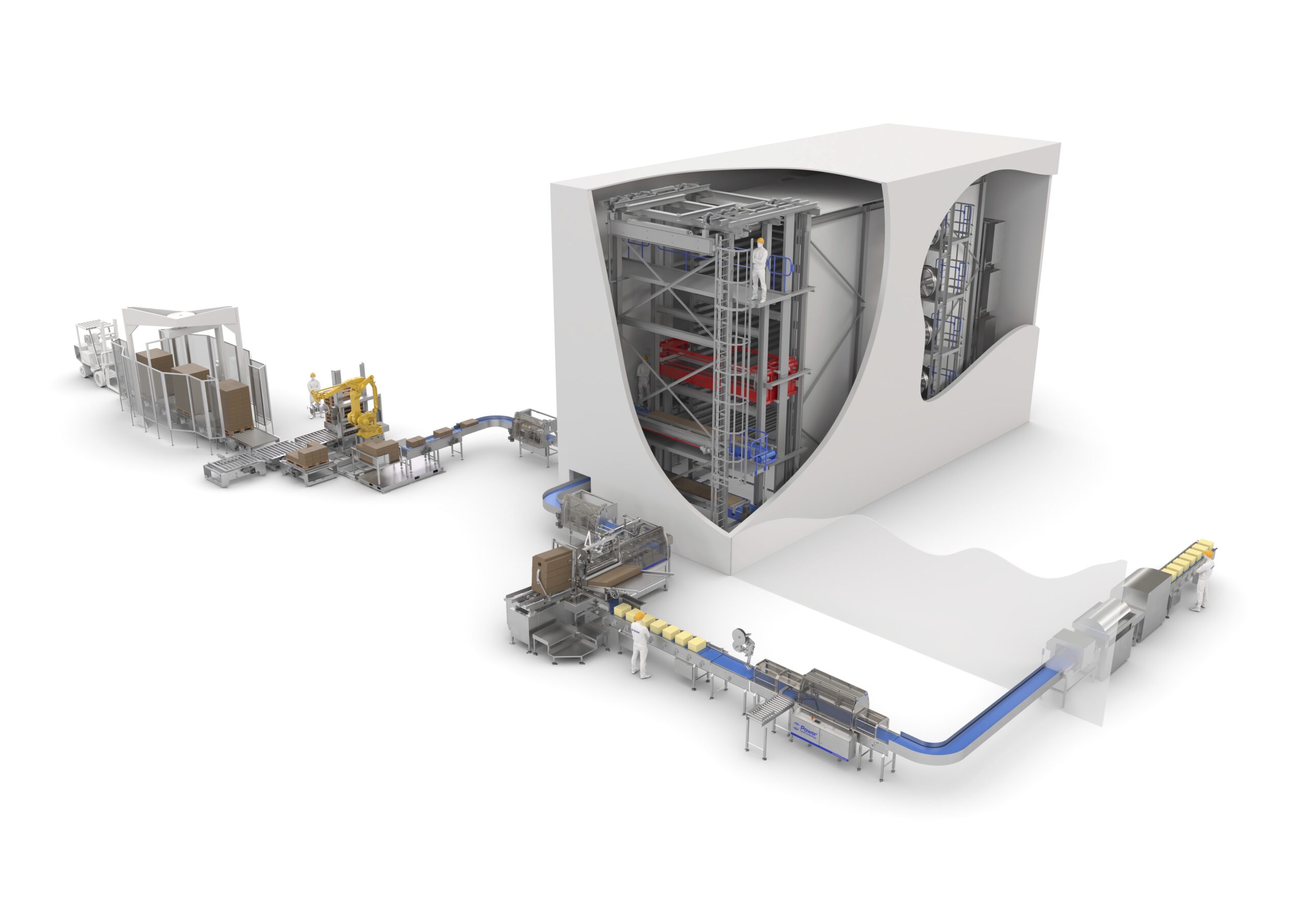

Preparing for the transformation, Egypt is putting the ITO, BPO, and KPO industries on the DX path. International companies operate BPO, ITO, and manufacturing outsourcing centers successfully in Egypt.

Egypt can provide offshore cloud services with the lowest latencies, the delay before a transfer of data begins following an instruction for its transfer. It also offers surprisingly high speeds to Europe and the Middle East. Helping the sector develop, the World Bank’s Doing Business 2017 report showed a marked increase within Egypt’s “Getting Electricity” measurement. Also, international bandwidth in 2016 was 1,134Gbps, an increase in capacity of 45% year on year.

Egypt’s attractiveness as an ICT base stems from Its reliable and scalable infrastructure, the abundant talent pool at a low cost which is increasingly multilingual and technical, a geographical location near large European & MENA clients with a similar time zone and substantial government investments to support the growth of the outsourcing industry.

Business Processing: Outsourcing has grown tremendously in Egypt. Services like translation, HR, finance, engineering, and software development are on the rise. Cultural compatibility, physical proximity, and a similar time zone have facilitated productive business interactions. In addition, Egypt’s attractive value proposition has placed the nation on track to become a major hub for business operations. Egypt’s outsourcing workforce stands at 170 000 employees, and they provide services for 100 countries in 20 different languages. BPO centers in Egypt have a much lower staff turnover rate than other global offshoring destinations ensuring better continuity. Egypt has evolved from a low-value to high-value services offering a full support system to international organizations.

International expertise: Egypt’s market share in the global offshore BPO market is nearly 16.9% in 2019. Instability following the 2011 revolution hardly affected the sector with clients not scaling down operations. Egypt’s front-office outsourcing sector never decreased. Multinational companies and organizations benefiting from Egypt’s conditions include IBM, Microsoft, HP, SAP, Vodafone, Huawei, Sutherland, Schneider Electric, Oracle, and Dell EMC amongst many others. National players include Raya and Teleperformance.

Egypt is increasingly leveraged by global companies as a gateway for the Middle East and African markets. Even during turbulent times, the sector has reported significant growth in business during the past six years. High demand from multi-national companies reflects the increased confidence in Egypt’s capabilities as an outsourcing destination. Egypt’s outsourcing value proposition is more relevant than ever, and therefore the Egyptian government has prioritized attracting new BPO investments.

In addition to the key European market, other strong clients of Egypt’s outsourced BPO services are in the US, Turkey, Saudi Arabia, UAE, South Africa, Nigeria, and Kenya.

The captive IT services market in Egypt is growing rapidly. It entails multinational companies using a wholly owned subsidiary instead of a third party vendor. This has allowed companies like IBM, Valeo, Mentor Graphics, Dell EMC, and Microsoft to capitalize on Egypt’s competitiveness while maintaining complete control over process and delivery.

Application-related IT services are also on the rise with exports nearing EUR 350 million. Software support, application customization, app development, and management outsourcing services are widely available.

The increasing number of graduating students with degrees in fields such as engineering, computer science, medicine, finance, and law are supporting the development of the sector. Product engineering is a fast-growing KPO field that is backing Egypt’s focus on building Electronic Manufacturing Services. Translation services are also on the rise with domestic, and global customers for the translation of websites, applications, scientific papers, and engineering documents. Another examples are legal process outsourcing and medical transcription services which are increasingly specialized taking advantage of the knowledge base of Egypt’s half million annual graduates.

Capitalizing on BPO experience and diversifying outside of KPO and BPO has been a challenge. To foment this, the government has placed a focus on growing export components of the IT industry through financial rebates.

Electronic Manufacturing Services: Egypt has huge assembly facilities producing consumer electronics valued at over EUR 3 500 million. Companies are increasingly focused on pushing exports of Egyptian manufactured products. So the abundance of engineering design talent and the cost-effective environment can boost Egypt’s EMS footprint.

The local market has several design service-oriented companies that through local manufacturers design components for international brands. Companies like Analog Devices, Mentor Graphics, and Axxceler use Egypt’s design houses. The large number of engineers in small local companies could increase Egypt’s market share within the global EMS sector.

Although the Ministry of ICT has tried to launch initiatives like “Egypt Makes Electronics,” very little information is available on their impact. The entity should consider improving its communication channels.

Data centers: Several global companies like NxtVn, CloudFare, Giza Systems, and Bright Computing are actively investing in data centers in Egypt and creating a data center cluster using the data-transfer speeds submarine cables offer Egypt. This segment will be bolstered by Liquid Telecom’s investments in Egypt in partnership with Telecom Egypt.

Innovation: Small start-up businesses in Egypt are increasingly securing millions of euro in investments from Europe, the US, and the MENA region. Ecosystem drivers include increasing smartphone penetration level, the New Administrative Capital’s Smart City utilization of Internet of Things (IoT) and big data analytics, new ICT Parks and a developing datacenter cluster.

There are some key flagship projects currently being implemented by the government to foster the sector’s innovation and growth. The European Outsourcing Association awards shortlisted Egypt as an outstanding destination in 2016, Forbes ranked Egypt within its Top 10 worldwide destinations for start-ups, and AT Kearney’s Global Retail Development Index in 2016 ranked Egypt 30th globally for growth potential.

Instabug: Egypt’s bug-reporting startup provides bug reporting, crash reporting, in-app chats, and user surveys for mobile apps. The company founded in 2012. In 2013, Instabug won first place in the MIT Enterprise Forum Arab Startup Competition. It has raised EUR 1.5 million in 2016. In 2018 tens of thousands of companies like Yahoo, eBay, PayPal, Lyft, Samsung and T-Mobile amongst many others relied on Instabug to enhance their app quality.

Nile X: The first Egyptian manufactured smartphone has been named after the Nile River. Produced by the Silicon Industries Corporation (SICO) in cooperation with Chinese Megan Group its first design was launched at the “Cairo ICT” fair in 2017. The company’s factory will be able to produce up to 1.8 million devices per year using 45% local components. Its current six smartphone and tablet designs use the Chinese equivalent of 3G/4G US technology. While private investors led the companies formation, it is 20% owned by the Ministry of ICT.

The phone seeks to capitalize on the increasing demand in Africa for affordable smartphones in the EUR 50 price range and will penetrate the broader African market in 2019. Its ambitions include exporting 40 percent of its production while increasing its national market share from 4% to 15% by the end of 2019. Total production in 2018 reached 500 000 units and is expected to rise to 1.5 million units in 2019. This increase would boost sales from EUR 19 million to EUR 58 million in 2019 and could reach EUR 122 million by 2020.

ICT Parks: There has been a persistent focus on building technology parks across the entire country. The endeavor seeks to secure billions of euro in funding, develop ICT parks, extend broadband nationally, and revive international investor interest.

Suitable office parks and infrastructure were built to meet the specific needs of the IT and BPO offshore services such as Smart Village and Maadi Park which can hold up to 100 000 employees. Several industry and technology-specific parks seek to replicate these models and are being built to attract global organizations.

These new technology parks will be home to multinational companies establishing local operations that can bring state of the art technologies and know-how while offering growing Egyptian enterprises the space to learn while supporting global operations.

Silicon Waha: A national initiative developing technology parks in second generation cities under the name WE Parks is providing ecosystems that enable Egyptian technology companies to create value through innovation. The entity is building BPO capable sites across Borg El Arab, New Assiut, 10th of Ramadan, Sadat City, Beni Suef, and Aswan amongst others.

Knowledge city: Massive investments are being implemented at the New Administrative Capital using “Internet of things and big data analytics. The NAC was designed as a Smart City with facilities that are managed through technological solutions in the hope their application will stimulate further specializations within the BPO sector. The project is meant to create an Egyptian Silicon Valley on a space of 1.234 square kilometers over three years with investments of EGP 28 million. A higher education system that meets international standards will be the main pillar, and the city should be the home of foreign university branches that focus on research, innovation, and entrepreneurship. Universities like Nile University are adding big data and analytics to their curriculum, so students take advantage of the nations increasing use of smart technologies.

Next Technology Leaders: The presidential initiative is targeted to bring high-level certified trainings through digital learning to 16 000 students. NTL provides government-funded degrees at global universities including MIT, Johns Hopkins, Universities of California, Texas, Virginia, amongst others. In addition, it collaborates in programs with IBM, Google, Amazon, Facebook or GitHub for students to learn emerging technologies that drive accelerated innovation through big data, internet of things, artificial intelligence, cybersecurity, amongst others.

IT Labour force: The sectors workforce has reached 212 000 in 2019. However, the attractiveness of Egypt lies in its innate offer and possibility to implant service centers on a large scale as the segment requires a constant supply of skilled workers. Over 35 universities and 100 institutes graduate nearly 500 000 annual students. Nearly half, 220 000 students studied a services related field that applies to the BPO sector. Egypt’s thriving resource pool yearly churns out 95 000 graduates in Engineering, 50 000 in ICT, and 67 000 in General Science. This, in turn, is enforced by cooperation with major players of multinational companies. Major enterprises like Cisco or Microsoft, amongst many others, are recurrently partnering with educational institutions to offer practical training programs.

Egyptian students are increasingly multilingual with the majority speaking English and an increasing number of French, German, Italian and Spanish alumni. In addition, thousands graduate with technical skills in Engineering, ICT and General Sciences amongst others. Egypt’s continued success in producing skilled graduates will increase its ability to deliver offshore services.

Business Process Outsourcing Costs: The average salaries of IT, BPO, and KPO employees in Egypt are low, and comparable with India. Egypt is delivering competitive offshoring services thanks to the competitive labor rates and floating of the currency.

Direct annual operation costs for multi-lingual contact centers in Egypt was already amongst the most competitive in the world. Egypt became even more affordable with the devaluation making it 60% cheaper as a base than more mature offshore destinations such as India, Philippines, and Malaysia.

Outlook: Egypt is on the right track in the development of its IT, BPO and KPO services export industry. Market share is growing, and the number of services is diversifying. However, to fully capitalize on the global offshoring potential Egypt must change its current mode of operation. The entire ICT sector must adapt to capitalize on its global perception as a cost arbitration center and highlight its value addition through innovation capabilities.

The creation of a thriving SME innovation and incubation culture should be set as a top priority with a focus on increasing the global visibility of success stories.

In addition, the Ministry of ICT should do more to properly communicate with stakeholders and increase the visibility of the sector to attract FDI while increasing the sectors reach.