The landmark new investment law, ratified in 2017, changed the landscape of business in Egypt. The law has modernized and reduced barriers to how international companies invest and operate in Egypt, offering incentives, simplifying the processes, guaranteeing protection from decisions that are arbitrary or capricious, and providing new tools to ease establishing, starting and operating a business in Egypt. The law also offers a wide range of tax breaks for investing, including a 50% cash back in the form of a tax refund over seven years when investing into underdeveloped regions, and additional rebates for industrial projects that launch production within two years of land acquisition. A reduction of red tape adds to assurances, as specifications for the length of time the government can take to approve licenses and clearances has also been implemented. With the passing of the new investment law, Egypt has witnessed economic growth, an increase in domestic production, exports and foreign investment. Egypt, now more than ever, has a competitive edge on the region.

The law guarantees a variety of unprecedented protections for international investors to encourage new development in Egypt: Foreign investors now receive the same treatment under the law as Egyptian nationals. With approval from the Council of Ministers, foreign investors can now be granted preferential treatment. Investments will not be governed by discriminatory decisions or arbitrary procedures. Investment projects will not be nationalized. Administrative authorities cannot revoke or suspend investment project licenses without proper warning including due process and time to correct issues. Investors have the right to transfer their profits abroad, and they are guaranteed residence in Egypt during the project. However, foreign employees must remain below 10%. For investment companies foreign employees, which cannot exceed 20%, have the right to transfer their compensation abroad.

In addition, the law also contains incentives and policies encouraging significant and targeted investments. This includes companies receiving 2% of the overall customs tax exemption on the value of imported equipment and machinery. This is down from the current 5%. These companies are also exempt from stamp tax and registration fees of articles of association, mortgages, loan agreements and land contract notarizations related to their investment. Special incentives include a deduction from taxable net profits in regions that are identifiable on the General Authority for Investment and Free Zones’ (GAFI) investment map. The GAFI investment map identifies special investment zones, needed projects, and land available to investors. The investment zones are designated geographic areas for specific developments including logistics, agriculture, and industry. Investors receive a 50% discount off investment costs in Sector A* for specified priority actions. Other incentives can include subsidized utilities, the allocation of land free of charge, and additional incentives given at the discretion of GAFI.

As the epicenter of investor services in Egypt, GAFI can streamline processes. Now investors can obtain all necessary licenses directly from GAFI, without having to interact with other authorities. GAFI has created electronic services to ease incorporation activities. Furthermore, companies that are involved in strategic or national interest projects (public-private partnerships, public utilities, infrastructure, new and renewable energy, roads and ports), are eligible for unified approval covering the establishment, operation, and management of the entire project, including the building licenses and real estate licenses.

Furthermore, the new investment law has amended the process for settlements of investment disputes. The Appeals Committee is responsible for considering complaints from decisions issued by the governmental authorities including the granting of permits, approvals, and licenses. The Ministerial Committee for the Resolution of Investment Disputes is responsible for the resolution of disputes arising between investors and the state governmental bodies.

The Ministry of Trade and Industry has, in addition, rolled out export incentives including a 12% cash back on locally manufactured value-added products. This is in addition to its 50% cash back on transport costs when exporting to Libya or Iraq.

Companies are already capitalizing on these momentous opportunities, and witnessing first hand the benefits of the new investment law in action. President Abdel Fattah El-Sisi’s encouragement of investment in national megaprojects, post the new investment law, has inspired a surge of investment, including into the Suez Canal Corridor. Companies like EgyCo and FedEx Express have promised additional investment into the Suez Canal Economic Zone. Egyptian Minister of Investment and International Cooperation, Dr. Sahar Nasr, has stated that there are more than 100 investment opportunities in the Suez Canal Corridor, and the aim is to turn it into a regional center for investment and a gateway to the over 100 million Egyptian consumers, 1.2 billion Africans, and 400 million Arabs.

To become eligible for special additional incentives, categories A and B have been determined:

Sector A: The Suez Canal Economic Zone, The Golden Triangle Economic Zone, other lagging, underdeveloped regions determined by the Ministerial Cabinet, offer a 50% discount off investment costs.

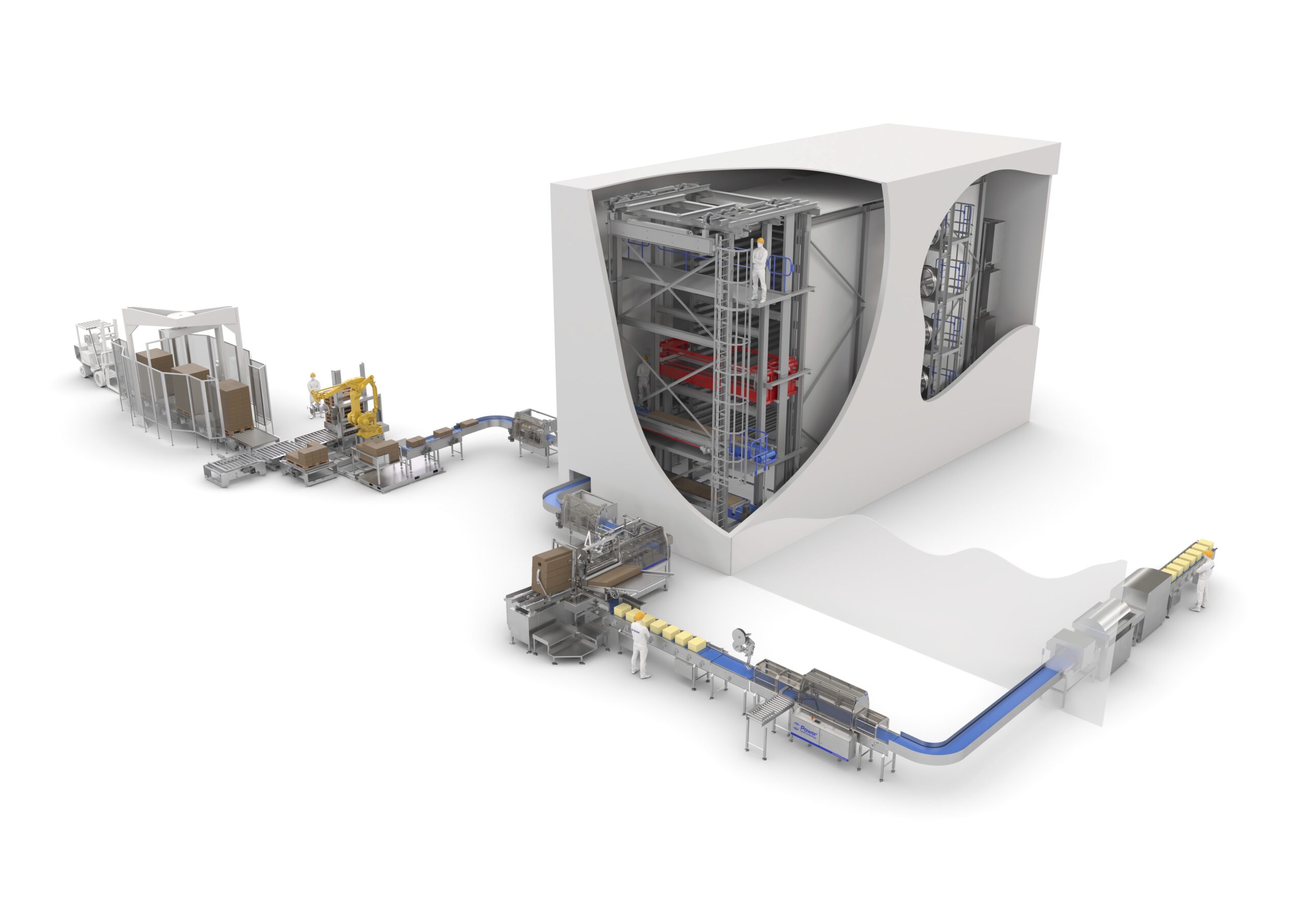

Sector B: Labor-intensive projects in accordance to regulations and restrictions stipulated in the Executive Regulations, small and medium enterprises, projects that depend on or produce new or renewable energy, megaprojects, projects defined as strategic projects, tourist projects, projects established for the production and distribution of electricity, projects that export no less than 50% of their production output and volume to countries outside the region, automotive projects and auto-feeding industries, wood, furniture, printing, packaging and chemical industries, manufacturing projects of antibiotics, oncology pharmaceuticals and cosmetics, food and beverage industries, agricultural crops production, companies and projects for the recycling of agriculture waste, engineering, metal and leather tanning industries, communication and information technology related industries; offer a 30% discount off investment costs.